오랜만에 계산 문제 하나 풀어볼게요. 재무계산기의 핵심 기능인 TMV(Time-Value of Money) 계산입니다! 오랜만에 계산 문제 하나 풀어볼게요. 재무계산기의 핵심 기능인 TMV(Time-Value of Money) 계산입니다!

원금 5000만원을 아래 4가지 상품 중 하나를 선택해서 예치하고자 합니다. 12개월 후에 가장 많은 이자를 받을 수 있는 상품은 어떤 것일까요? 원금 5000만원을 아래 4가지 상품 중 하나를 선택해서 예치하고자 합니다. 12개월 후에 가장 많은 이자를 받을 수 있는 상품은 어떤 것일까요?

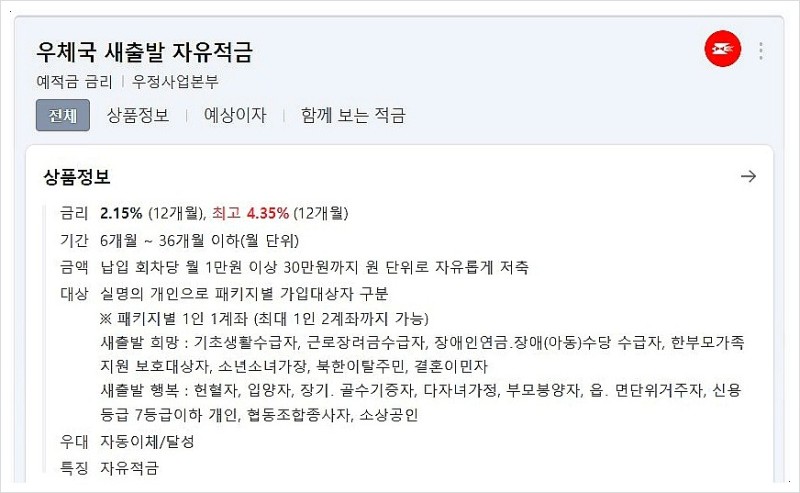

상품연이율 복리주기 1.KB발행어음 CMA일복리 3.4% 1일x3652.KB발행어음 분기복리 3.75% 3개월x43.KB발행어음 반기복리 4.05% 6개월x24.새마을금고 정기예금 연단리 5.35% 12개월 상품연이율 복리주기 1.KB발행어음 CMA일복리 3.4% 1일x3652.KB발행어음 분기복리 3.75% 3개월x43.KB발행어음 반기복리 4.05% 6개월x24.새마을금고 정기예금 연단리 5.35% 12개월

일복리 연 3.4%@CMA 발행어음(KB증권) 금리가 연 3.7%에서 며칠 전 3.6으로 떨어지는 줄 알았는데 다시 3.4로 내려갔습니다. ㅠ 이제 임시자금을 파킹···blog.naver.com 일복리 연 3.4%@CMA 발행어음(KB증권) 금리가 연 3.7%에서 며칠 전 3.6으로 떨어지는 줄 알았는데 다시 3.4로 내려갔습니다. ㅠ 벌써 임시자금을 파킹…blog.naver.com

5.35% 정기예금 새마을금고 3개 @구로구 예금금리가 다시 오르고 있는 중입니다. 저는 올해 저축하기로 한 금액을 매달 일정액에 나눠서 쌓고 있는데요… blog.naver.com 5.35% 정기예금 새마을금고 3개@구로구 예금금리가 다시 오르고 있는 중입니다. 저는 올해 저축하기로 한 금액을 매달 일정액으로 나누어 쌓고 있는데…blog.naver.com

simonesecci, 출처 Unsplash simonesecci, 출처 Unsplash

Attached is the HP Financial Calculator Manual. Attached is the HP Financial Calculator Manual.

Calculations with a compound interest period of less than one year cannot be calculated by the neighbor compound interest calculator. If you look for it, there is a website for calculating on the web, and you can calculate on Excel, but the financial calculator is easy to calculate quickly. Calculations with a compound interest period of less than one year cannot be calculated by the neighbor compound interest calculator. If you look for it, there is a website for calculating on the web, and you can calculate on Excel, but the financial calculator is easy to calculate quickly.

Financial calculator recommendation HP10bII+Financial Calculator, Latte Effect (benefit effect), and Hangul Manual started investing in stocks last year and calculated more. In particular, if you are interested in pensions, you will have to start investing in stocks and calculate more frequently last year, including HP10bII+Financial Calculator recommended by blog.naver.com Financial Calculator, Latte Effect (benefit effect), and Hangul Manual. Especially when you become interested in pensions, compounded and long… blog.naver.com

If you actually do the calculations on the financial calculator in the four cases above, the interest you will receive after 12 months is as follows. If you actually do the calculations on the financial calculator in the four cases above, the interest you will receive after 12 months is as follows.

Annual interest rate compounding cycle 12 months later, principal + interest No. 1 increase compared to CMA 1. KB Issuance Note CMA 3.4% KRW 51,729,148 per day – 2. KB Issuance Note 3.75% 3 months 51,901,532 won + 172,384 won 3. KB Issuance Note 4.05% 6 months 52,045,503 won + 316,355 won 4. Saemaeul Bank’s regular deposit 5.35% 12 months 52,675,000 won + 945,852 won 12 months after the annual interest rate compounding cycle, principal + interest 1 increase compared to CMA 1. KB Issuance Note CMA 3.4% KRW 51,729,148 per day – 2. KB Issuance Note 3.75% 3 months 51,901,532 won + 172,384 won 3. KB Issuance Note 4.05% 6 months 52,045,503 won + 316,355 won 4. Saemaeul Bank’s fixed deposit 5.35% 12 months 52,675,000 won + 945,852 won

In one case, if you write down the required input for calculating only three 6-month compounded products, you will see the following. First line: Input compound interest cycle (turn 2 in 6 months within 1 year) N: Number of times to put money in (6 months, 2 times, 2 times) I/YR: Annual interest rate (annual interest rate is 4.05%) PV: Present value (current value is minus -50,000,000 won) PMT: Payment (not applicable) FV: Future value (next value, 52). First line: Input compounding cycle (turn 2 in 6 months within 1 year) N: Number of times to put money in (turn 2 in 6 months) I/YR: Annual interest rate (annual interest rate is 4.05%) PV: Present value (current value is minus -50,000,000 won) PMT: Payment (not applicable) FV: Future value (pressing value above 45V)

The higher the interest rate, the more advantageous it is. Due to high interest rates, 12-month fixed deposits are the most advantageous to keep them tied up without other investments or use places for 12 months. However, if you cancel in the middle, interest will be greatly reduced and opportunity costs will be lost. Therefore, if you can predict the time of investment, you can choose the product twice or three times, and if you can’t predict the time of investment, you can wait with a low interest rate of 3.4% compounded at a time, but slightly inflated. Recently, we are considering moving funds from No. 1 to No. 3 while gradually reducing No. 4 deposits. The higher the interest rate, the more advantageous it is. Due to high interest rates, 12-month fixed deposits are the most advantageous to keep them tied up without other investments or use places for 12 months. However, if you cancel in the middle, interest will be greatly reduced and opportunity costs will be lost. Therefore, if you can predict the time of investment, you can choose the product twice or three times, and if you can’t predict the time of investment, you can wait with a low interest rate of 3.4% compounded at a time, but slightly inflated. Recently, we are considering moving funds from No. 1 to No. 3 while gradually reducing No. 4 deposits.

Based on calculation, not blind faith, compound interest should be our religion. Based on calculation, not blind faith, compound interest should be our religion.

Nevertheless, people cannot calculate compound interest on their heads, so shouldn’t they press the calculator from time to time? Nevertheless, people cannot calculate compound interest on their heads, so shouldn’t they press the calculator from time to time?

출처 OGQ, Cool Public Domains 출처 OGQ, Cool Public Domains